Uncategorized

Employer Group Insurance Trends for Summer 2025

As we’re now in summer 2025, employer group insurance is at a crossroads. Rising costs and shifting workforce expectations are reshaping the landscape—and Michele Sanchez Insurance Agency is here to help local businesses in Southwest Florida navigate these changes effectively. Healthcare Cost Trends: A Steep Climb Continues Projected healthcare cost trend is nearly 8% in 2025,…

Read MoreTravel Medical Insurance Trends in 2025: What Every Smart Traveler Needs to Know

Increased Demand for Travel Medical Insurance Travel Medical Insurance used to be an afterthought, but is now a must-have in 2025. Back in 2023, only about 10% of U.S. travelers purchased travel insurance. Fast forward to 2025, and nearly 65% are choosing to protect themselves. Why? Because delays, cancellations, and overseas medical emergencies are more…

Read MoreTravel Smart in 2025: Why I Always Recommend Comprehensive Travel Medical Insurance

As someone who’s helped travelers navigate insurance for years, I can tell you that comprehensive travel medical insurance isn’t just a good idea in 2025—it’s essential. Whether you’re headed across the country or around the world, having the right coverage can protect you from the unexpected and give you peace of mind. Why Medical and…

Read MoreWhat If You Missed the Annual Enrollment Period?

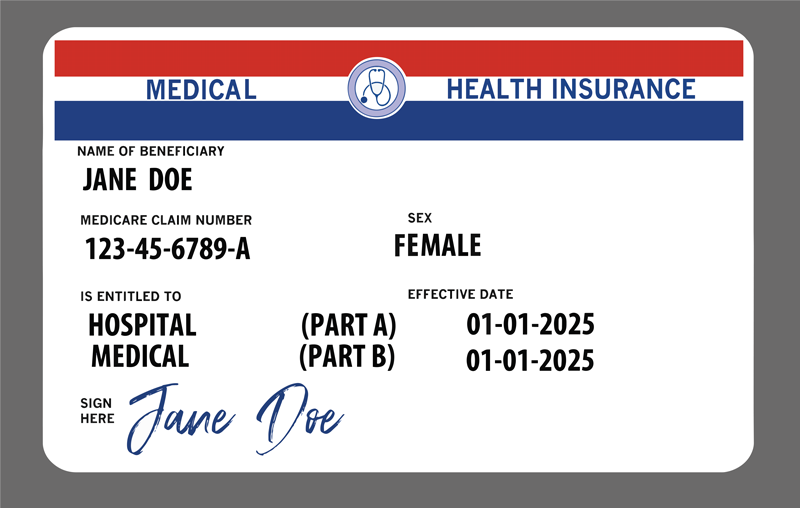

The Medicare Annual Enrollment Period (AEP) comes around every year between October 15 and December 7, giving you the chance to review and adjust your Medicare coverage. But what happens if the AEP passes and you didn’t make any changes? First, don’t panic—you may still have options! The good news is that depending on your…

Read MoreThe 2025 Medicare Enrollment Period is Now Over: What Comes Next?

The annual Medicare Enrollment Period (AEP) for 2025 has officially come to a close. If you recently reviewed or made changes to your Medicare plan during this time, you might be wondering—what happens next? Whether this was your first time navigating Medicare or you’ve been through the process before, it’s important to know what to…

Read MoreWhat to Expect During Medicare Open Enrollment (October 15 – December 7)

What to Expect During Medicare Open Enrollment (October 15 – December 7) Medicare Open Enrollment is a crucial time for millions of beneficiaries across the country. It’s the period when people can review their healthcare coverage, make changes to their plans, and ensure they’re set up for the coming year. Whether you’re new to Medicare…

Read MoreUnderstanding Medicare Part B Givebacks: What You Need to Know

As the Medicare Annual Enrollment Period (AEP) approaches, a growing number of Medicare Advantage plans are promoting an attractive feature: Medicare Part B givebacks. These givebacks, also known as Part B premium reductions or Social Security givebacks, are designed to reduce the amount you pay for your Medicare Part B premium. But how do these…

Read MoreA Hurricane Emergency & Your Health Insurance

As Florida residents, we know hurricanes can be unpredictable and devastating, disrupting daily life and even posing significant health risks. When a hurricane threatens our area, it’s crucial to know how your health insurance plan can support you during an evacuation or emergency. Hurricane Emergency & Your Health Insurance Understanding your coverage can make a…

Read MoreMedicare Supplement Plans: Are You Getting the Most Out of Your Coverage This Summer?

Summer is a time for fun, relaxation, and enjoying the great outdoors. But it’s also a time when healthcare needs can change, and it’s important to ensure that your Medicare Supplement Plans, also known as Medigap, is working for you. These plans can help cover costs that Original Medicare doesn’t, such as copayments, coinsurance, and…

Read MoreWhy Summer is the Perfect Time to Review Your Health Insurance Plan

Summer is a season of relaxation, vacations, and more free time than usual. It’s also the Perfect Time to review your health insurance and potentially update your health insurance plan. While it might not be the first thing on your summer to-do list, taking the time to evaluate your health insurance during these warmer months…

Read More